Online discussions about a possible $2,000 IRS payment arriving in February 2026 have sparked widespread interest. For many households, that figure represents meaningful financial relief. But is this a newly approved federal stimulus check, or something else entirely?

Here is a clear, fact-based breakdown of what the $2,000 amount most likely represents, who may qualify, and how the direct deposit timeline typically works during tax season.

Is There a New $2,000 Stimulus Check for February 2026?

As of now, there is no officially confirmed nationwide $2,000 federal stimulus payment scheduled for February 2026.

When Congress approves a stimulus program, it is publicly announced through formal legislation, with clearly defined eligibility requirements, income thresholds, and payment timelines. No such federal program has been confirmed for February 2026.

In most cases, references to a $2,000 IRS payment are connected to:

- Federal tax refunds

- Refundable tax credits

- Recovery of previously unclaimed benefits

- State-level relief payments

Understanding the distinction between a stimulus check and a tax refund is essential to avoid confusion.

What the $2,000 Amount Could Actually Represent

For many taxpayers, a $2,000 payment in February may reflect their individual tax refund amount rather than a universal government payout.

Several scenarios could result in a refund around that figure.

Federal Tax Refund From 2025 Returns

If you overpaid federal taxes during 2025 through paycheck withholding or estimated payments, you may receive a refund after filing your return in early 2026.

The exact amount depends on income, deductions, credits, and withholding accuracy.

Child Tax Credit

Families with qualifying children may receive refundable portions of the Child Tax Credit, which can significantly increase total refund amounts.

Earned Income Tax Credit (EITC)

Eligible low- to moderate-income workers may qualify for the Earned Income Tax Credit, which is refundable and can substantially raise refund totals.

Recovery of Unclaimed Credits

Taxpayers who missed claiming certain credits in prior filings may receive additional amounts once corrections are processed.

State-Level Relief Payments

Some states administer separate relief programs or refundable credits that may be deposited around tax season. These are not federal payments and vary by location.

In many cases, the $2,000 figure is simply an estimated average refund amount rather than a guaranteed payment.

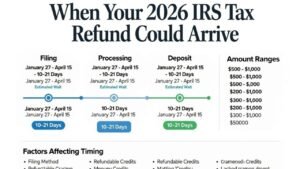

Expected Direct Deposit Timeline in February 2026

If the $2,000 refers to a federal tax refund, the timing follows standard IRS processing rules.

Typically:

- The IRS begins accepting tax returns in late January.

- Refunds are often issued within 21 days of electronic filing and acceptance.

- Taxpayers who file early and select direct deposit may receive refunds in February.

Direct deposit remains the fastest and most secure payment method. Paper checks generally take significantly longer due to mailing and processing times.

However, refund timing can be affected by:

- Errors or incomplete information

- Identity verification reviews

- Claims involving refundable credits subject to additional review

- Bank processing times

Early filing combined with accurate documentation helps minimize delays.

Who May Qualify for a $2,000 Refund?

There is no automatic $2,000 payment issued to all Americans.

Eligibility for any refund amount depends on several individual factors:

- Annual income

- Filing status (single, married filing jointly, head of household)

- Number of dependents

- Tax credits claimed

- Total taxes withheld during the year

Families with dependents and individuals eligible for refundable credits are more likely to receive larger refunds.

Conversely, taxpayers who had minimal tax withholding or higher income levels may receive smaller refunds or potentially owe additional tax.

Refund amounts are personalized and vary widely.

How to Check Your Refund Status

After filing a federal return, taxpayers can monitor refund progress using the IRS official tracking tool.

To check your status, you typically need:

- Social Security number or Individual Taxpayer Identification Number

- Filing status

- Exact refund amount

Status updates usually appear within 24 hours after electronic filing.

It is critical to use only official IRS platforms when tracking payments. Avoid websites or social media posts that request personal information in exchange for early access to funds.

The IRS does not charge fees to release refunds.

Why $2,000 Payment Headlines Spread Quickly

Large payment figures naturally generate attention. During tax season, average refund amounts often circulate in headlines without clarifying that those figures are estimates rather than universal payments.

Additionally:

- Tax refund averages vary by income group

- Credit eligibility differs from household to household

- Social media posts sometimes present projections as confirmed payments

Financial clarity requires separating verified government announcements from speculative or promotional claims.

When evaluating payment rumors, always ask:

- Has Congress passed legislation?

- Has the IRS issued an official statement?

- Is there published eligibility guidance?

If the answer is no, the claim likely refers to refunds or credit-based payments rather than new stimulus money.

Tips for Maximizing Your Refund

While there is no guaranteed $2,000 payment, taxpayers can take proactive steps to optimize their refund potential:

- Ensure accurate withholding throughout the year

- Review eligibility for refundable credits

- Claim all qualifying dependents

- File electronically

- Select direct deposit

Working with a qualified tax professional or using reputable tax software can help identify overlooked credits and reduce filing errors.

Accurate preparation remains the most effective way to secure the refund you are entitled to receive.

Final Takeaway

There is currently no confirmed universal $2,000 IRS stimulus payment scheduled for February 2026.

In most cases, references to a $2,000 payment relate to individual tax refunds, refundable credits, or state-based relief programs. Actual amounts depend entirely on personal income, filing status, tax credits, and withholding levels.

Taxpayers seeking clarity should file accurately, choose direct deposit for faster processing, and rely exclusively on official IRS communications for verified updates.

Disclaimer: Payment amounts, eligibility, and deposit timelines depend on individual tax circumstances and official government approval. For personalized guidance, consult the IRS website or a certified tax professional.