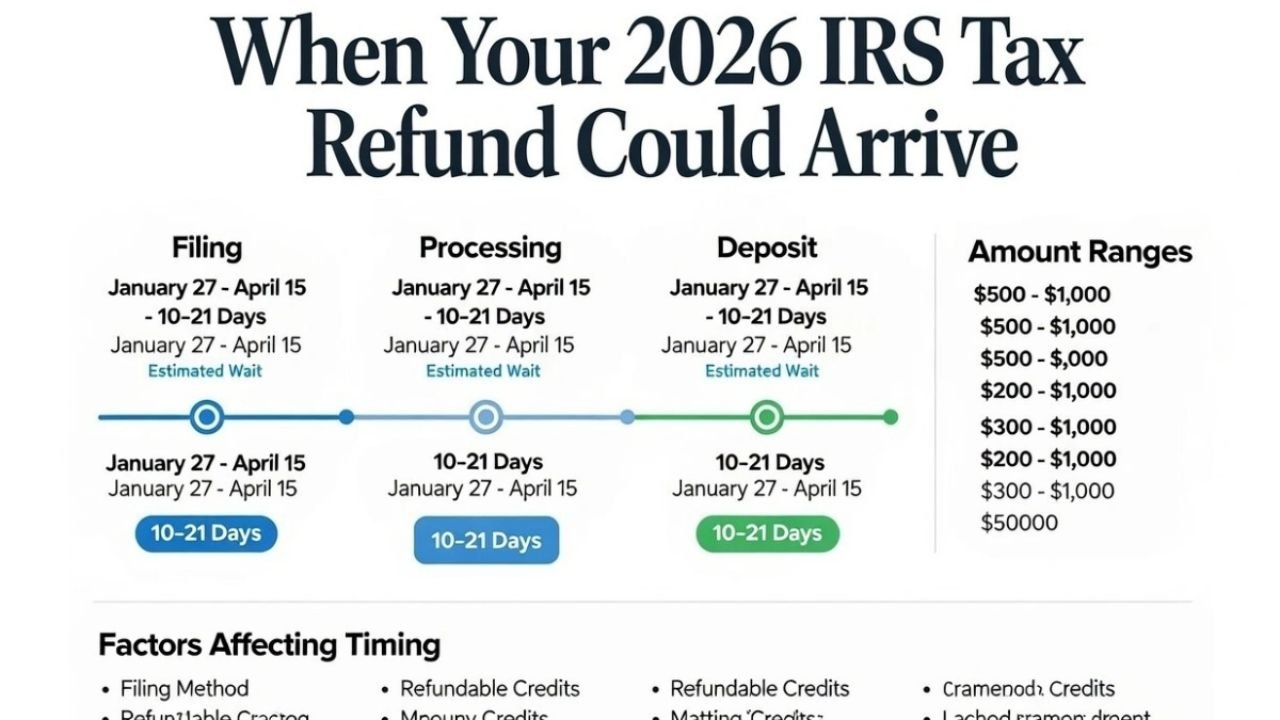

When Your 2026 IRS Tax Refund Could Arrive: Expected Deposit Windows, Amount Ranges, and What Affects Timing

As the 2026 tax season unfolds, millions of taxpayers are asking two essential questions: When will my IRS refund arrive, and how much will it be?

While the Internal Revenue Service does not guarantee exact payment dates, historical processing patterns offer a reliable framework for estimating realistic refund windows. Understanding how the system works can help you plan smarter, reduce uncertainty, and avoid unnecessary stress during tax season.

Here’s what to expect in 2026.

How the IRS Refund Process Works in 2026

The IRS typically opens the federal tax filing season in late January. Once your return is electronically submitted and officially accepted, the processing clock begins.

For most electronically filed returns with direct deposit selected, refunds are issued within approximately 21 days — assuming there are no errors, credit-related holds, or identity verification flags.

Paper-filed returns, on the other hand, can take significantly longer due to manual handling and mail delivery timelines.

Several factors influence both refund timing and amount:

- Filing method (electronic vs. paper)

- Direct deposit vs. mailed check

- Credits claimed

- Accuracy of information submitted

- IRS workload and compliance reviews

The smoother your filing, the faster your refund is likely to move through the system.

Early Refund Deposits: Late January to Mid-February

Taxpayers who file electronically as soon as the filing window opens are often first in line.

If your return is simple — meaning no refundable credits and no discrepancies — deposits may begin arriving in early to mid-February 2026. The exact timing depends on:

- The date your return is accepted

- IRS batch processing cycles

- Your bank’s posting schedule

Early filers who choose direct deposit and submit clean returns typically experience the fastest turnaround.

Simple returns with W-2 income and no refundable credits often move through the system most efficiently.

Mid-Season Refund Window: February to March 2026

The majority of 2026 refunds are expected to be issued between mid-February and late March.

This window covers:

- Most electronically filed returns

- Refunds requiring minor verification

- Returns processed after the initial filing rush

Refund amounts during this period vary widely. Some taxpayers may receive a few hundred dollars, while others receive several thousand depending on:

- Total income

- Federal tax withholding

- Credits claimed

- Household size

For most Americans, this is the most common refund timeframe.

Refunds Delayed Until Late March or April

Certain refunds are legally delayed under federal rules.

Returns that include refundable credits such as:

- Earned Income Tax Credit (EITC)

- Additional Child Tax Credit (ACTC)

are typically held until at least mid- to late February to reduce fraud and identity theft risks. Even when filed early, these returns often move more slowly through the approval system.

Additional delays may occur if:

- Information does not match IRS records

- Income discrepancies are flagged

- Identity verification is required

- Bank details are incorrect

- Supporting documentation is missing

In these cases, refunds may extend into late March or April.

Understanding this possibility helps set realistic expectations.

What Determines Your Refund Amount

Refund amounts are not fixed or standardized. They are based entirely on your personal tax profile.

Key variables include:

- Total annual income

- Amount of federal taxes withheld from paychecks

- Filing status

- Number of dependents

- Eligibility for refundable credits

- Adjustments such as education credits or childcare expenses

Taxpayers who had more withheld than their final tax liability will receive a refund for the difference.

Families with dependents and qualifying credits often receive larger refunds. Single filers with accurate withholding may receive smaller refunds — or none at all.

There is no universal “average” refund that applies to everyone.

Why Direct Deposit Makes a Difference

Direct deposit remains the fastest and most reliable way to receive a tax refund.

Mailed paper checks can add weeks due to:

- Check printing timelines

- Postal delivery delays

- Address verification issues

Incorrect bank account information is one of the most common causes of refund delays. Even a minor error in routing or account numbers can disrupt processing.

Selecting direct deposit and double-checking banking details significantly reduces wait times.

For taxpayers seeking efficiency, electronic filing plus direct deposit is the optimal combination.

How to Track Your 2026 Refund Status

The IRS provides official online tools allowing taxpayers to monitor refund progress.

After filing electronically, status updates typically appear within 24 hours. These updates show whether your return is:

- Received

- Approved

- Sent for payment

Checking through official IRS platforms ensures accuracy and protects against misinformation.

Avoid relying on third-party refund countdown charts or unofficial estimates. These cannot account for individual return complexities.

If the IRS requires additional information, official communication will be sent directly to you.

Why Estimated Dates Are Not Guarantees

Even under ideal circumstances, refund timing can vary.

Possible external factors include:

- High filing volumes

- IRS staffing levels

- Compliance reviews

- Banking system delays

- National holidays

The IRS consistently advises taxpayers not to rely on refunds for urgent financial obligations until funds are officially deposited.

Flexibility during tax season is essential. Planning conservatively helps avoid financial pressure.

Smart Filing Strategies for Faster Refunds

If your goal is to receive your refund as quickly as possible in 2026, consider these best practices:

- File electronically

- Choose direct deposit

- Double-check all personal and banking details

- Attach required forms and documentation

- Avoid last-minute filing errors

- Respond promptly to IRS notices

Accuracy is more important than speed. A clean return filed slightly later often processes faster than an early return requiring corrections.

Final Takeaway

In 2026, most IRS tax refunds are expected to arrive between mid-February and late March, with some extending into April depending on credits, filing method, and review requirements.

Electronic filing combined with direct deposit remains the fastest path to receiving funds. Refund amounts vary widely based on income, withholding, and credits — there is no guaranteed standard payout.

Understanding realistic processing windows allows taxpayers to plan with confidence and reduce uncertainty during tax season.

Disclaimer: Refund timelines and amounts depend on individual tax circumstances and IRS processing conditions. This article provides general informational guidance only. Taxpayers should rely on official IRS resources and qualified tax professionals for personalized advice.